Healthcare Logistics Market Size to Grow by USD 33.64 Bn at a CAGR of 6.39%| Pharmaceutical Products is expected to witness lucrative growth | Technavio

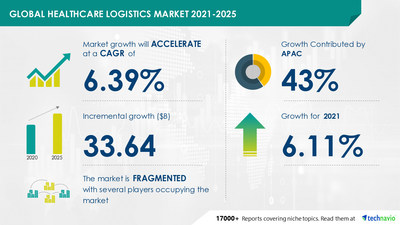

NEW YORK, May 27, 2022 /PRNewswire/ — The Healthcare Logistics Market size is expected to grow by USD 33.64 billion with a YOY growth of 6.11% during the forecast period. One of the key factors driving the healthcare logistics market growth is the growing global pharmaceutical sales. The report offers an up-to-date analysis of the current market scenario and information from several leading manufacturers.

For more insights on YOY and CAGR, Request Latest Sample Report.

This market research report extensively covers Healthcare Logistics Market segmentations by the following:

- Product- Pharmaceutical products and medical devices

- Pharmaceutical products will gain a large proportion of the healthcare logistics market. Branded medications, generic drugs, and vaccines are all examples of pharmaceutical products. The demand for pharmaceutical logistics is likely to rise as the number of new medicine approvals rises. As a result, logistics companies can easily adapt or set up their existing logistics or warehousing units for new items in response to pharmaceutical manufacturers’ needs.

- Geography – APAC, North America, Europe, South America, APAC, North America, Europe, and South America

- APAC will account for 43 percent of market growth. In APAC, China is the most important market for healthcare logistics. The market in this region will increase at a quicker rate than the market in other regions. The expected increase in healthcare spending may present numerous chances for pharmaceutical manufacturers and healthcare logistics suppliers, enhancing healthcare logistics demand in APAC throughout the forecast period.

Get more insights into this market’s growth with a detailed analysis of the top regions, View our Sample Report!

Healthcare Logistics Market Dynamics

Market Driver

Global pharmaceutical sales are one of the primary drivers driving the healthcare logistics market forward. Prescription pharmaceuticals and over-the-counter drugs make up the worldwide pharmaceutical market, which is predicted to rise significantly over the forecast period. The market is being driven by the expanding elderly population as well as new product launches by pharmaceutical companies.

Market Trend

An increasing number of initiatives to promote cold chain logistics are also propelling the healthcare logistics industry forward. In nations like Brazil, China, India, and South Africa, the cold chain market is still in its early stages. As a result, international regulatory agencies and governments from many nations have created several legislations focusing on food and medicine safety in order to support cold chains.

Market Challenge

One of the major issues impeding the growth of the healthcare logistics industry is the increased complications caused by time-bound deliveries and supply chain customization. Customers desire shorter lead times, while logistics organizations strive to maintain operational costs as low as possible. Selecting or constructing the correct supply chain model is a significant and critical job. Topography, technological advancements, and region/country-specific legislation and policies all influence logistics difficulties. This makes developing an effective supply chain model difficult for logistics service providers.

Our reports cover all the major factor that drives a market along with the challenges. To get a detailed understanding of the market trend, Click here to BUY now!

|

Healthcare Logistics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.39% |

|

Market growth 2020-2024 |

$ 33.64 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

6.11 |

|

Regional analysis |

APAC, North America, Europe, South America, APAC, North America, Europe, and South America |

|

Performing market contribution |

APAC at 43% |

|

Key consumer countries |

China, US, Germany, and Canada |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Air Canada, AmerisourceBergen Corp., CEVA Logistics AG, Cold Chain Technologies LLC, Continental Cargo OU, DB Schenker, Deutsche Post AG, FedEx Corp., Kuehne + Nagel International AG, and United Parcel Service Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Healthcare Logistics Market Segmentation

- Product

- Pharmaceutical Products

- Medical Devices

- Service

- Transportation

- Warehousing

- Geographic

- APAC

- North America

- Europe

- South America

- APAC

- North America

- Europe

- South America

Download Sample Report: to know additional highlights and key points on various market segments and their impact in coming years.

Healthcare Logistics Market Vendor

The growing competition in the market is compelling vendors to adopt various growth strategies such as promotional activities and spending on advertisements to improve the visibility of their services. Some vendors are also adopting inorganic growth strategies such as M&As to remain competitive in the market.

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Air Canada

- AmerisourceBergen Corp.

- CEVA Logistics AG

- Cold Chain Technologies LLC

- Continental Cargo OU

- DB Schenker

- Deutsche Post AG

- FedEx Corp.

- Kuehne + Nagel International AG

- United Parcel Service Inc.

Find out the top market vendors, their competition, and how they excel in the Healthcare Logistics Market in our latest Sample Report. Download our Detailed Sample Report.

Product Insights and News

- Air Canada – The company offers a wide range of healthcare logistics services which includes air freight services, ocean freight services, ground transportation, contract logistics, and supply chain solutions for pharmaceutical products and medical devices.

- AmerisourceBergen Corp – The company offers a wide range of healthcare logistics services which includes air freight services, ocean freight services, ground transportation, contract logistics, and supply chain solutions for pharmaceutical products and medical devices.

- CEVA Logistics AG– The company offers a wide range of healthcare logistics services which includes air freight services, ocean freight services, ground transportation, contract logistics, and supply chain solutions for pharmaceutical products and medical devices.

Do reach out to our analysts for more customized reports as per your requirements. Speak to our Analyst now!

Related Reports

Wine Logistics Market- The rising demand for wine in China is notably driving the wine logistics market growth. Download our Exclusive Reports Now!

Cross-border E-commerce Logistics Market – The increasing penetration of mobile computing devices is notably driving the cross-border e-commerce logistics market growth. Download our Exclusive Reports Now!

Table of Contents

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: Air Freight and Logistics Market

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.3 Market size 2020

- 3.4 Market outlook: Forecast for 2020 – 2025

- Exhibit 06: Global – Market size and forecast 2020 – 2025 ($ billion)

- Exhibit 07: Global market: Year-over-year growth 2020 – 2025 (%)

4 Five Forces Analysis

- 4.1 Five forces summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition – Five forces 2020

5 Market Segmentation by Product

- 5.1 Market segments

- Exhibit 15: Product – Market share 2020-2025 (%)

- 5.2 Comparison by Product

- Exhibit 16: Comparison by Product

- 5.3 Pharmaceutical products – Market size and forecast 2020-2025

- Exhibit 17: Pharmaceutical products – Market size and forecast 2020-2025 ($ billion)

- Exhibit 18: Pharmaceutical products – Year-over-year growth 2020-2025 (%)

- 5.4 Medical devices – Market size and forecast 2020-2025

- Exhibit 19: Medical devices – Market size and forecast 2020-2025 ($ billion)

- Exhibit 20: Medical devices – Year-over-year growth 2020-2025 (%)

- 5.5 Market opportunity by Product

- Exhibit 21: Market opportunity by Product

6 Market Segmentation by Service

- 6.1 Market segments

- Exhibit 22: Service – Market share 2020-2025 (%)

- 6.2 Comparison by Service

- Exhibit 23: Comparison by Service

- 6.3 Transportation – Market size and forecast 2020-2025

- Exhibit 24: Transportation – Market size and forecast 2020-2025 ($ billion)

- Exhibit 25: Transportation – Year-over-year growth 2020-2025 (%)

- 6.4 Warehousing – Market size and forecast 2020-2025

- Exhibit 26: Warehousing – Market size and forecast 2020-2025 ($ billion)

- Exhibit 27: Warehousing – Year-over-year growth 2020-2025 (%)

- 6.5 Market opportunity by Service

- Exhibit 28: Market opportunity by Service

7 Customer landscape

8 Geographic Landscape

- 8.1 Geographic segmentation

- Exhibit 30: Market share by geography 2020-2025 (%)

- 8.2 Geographic comparison

- Exhibit 31: Geographic comparison

- 8.3 APAC – Market size and forecast 2020-2025

- Exhibit 32: APAC – Market size and forecast 2020-2025 ($ billion)

- Exhibit 33: APAC – Year-over-year growth 2020-2025 (%)

- 8.4 North America – Market size and forecast 2020-2025

- Exhibit 34: North America – Market size and forecast 2020-2025 ($ billion)

- Exhibit 35: North America – Year-over-year growth 2020-2025 (%)

- 8.5 Europe – Market size and forecast 2020-2025

- Exhibit 36: Europe – Market size and forecast 2020-2025 ($ billion)

- Exhibit 37: Europe – Year-over-year growth 2020-2025 (%)

- 8.6 MEA – Market size and forecast 2020-2025

- Exhibit 38: MEA – Market size and forecast 2020-2025 ($ billion)

- Exhibit 39: MEA – Year-over-year growth 2020-2025 (%)

- 8.7 South America – Market size and forecast 2020-2025

- Exhibit 40: South America – Market size and forecast 2020-2025 ($ billion)

- Exhibit 41: South America – Year-over-year growth 2020-2025 (%)

- 8.8 Key leading countries

- Exhibit 42: Key leading countries

- 8.9 Market opportunity by geography

- Exhibit 43: Market opportunity by geography ($ billion)

9 Drivers, Challenges, and Trends

- 9.1 Market drivers

- 9.2 Market challenges

- Exhibit 44: Impact of drivers and challenges

- 9.3 Market trends

10 Vendor Landscape

- 10.1 Overview

- Exhibit 46: Vendor landscape

- 10.2 Landscape disruption

- Exhibit 47: Landscape disruption

- Exhibit 48: Industry risks

11 Vendor Analysis

- 11.1 Vendors covered

- 11.2 Market positioning of vendors

- Exhibit 50: Market positioning of vendors

- 11.3 Air Canada

- Exhibit 51: Air Canada – Overview

- Exhibit 52: Air Canada – Business segments

- Exhibit 53: Air Canada – Key offerings

- Exhibit 54: Air Canada – Segment focus

- 11.4 AmerisourceBergen Corp.

- Exhibit 55: AmerisourceBergen Corp. – Overview

- Exhibit 56: AmerisourceBergen Corp. – Business segments

- Exhibit 57: AmerisourceBergen Corp. – Key news

- Exhibit 58: AmerisourceBergen Corp. – Key offerings

- Exhibit 59: AmerisourceBergen Corp. – Segment focus

- 11.5 CEVA Logistics AG

- Exhibit 60: CEVA Logistics AG – Overview

- Exhibit 61: CEVA Logistics AG – Business segments

- Exhibit 62: CEVA Logistics AG – Key offerings

- Exhibit 63: CEVA Logistics AG – Segment focus

- 11.6 Cold Chain Technologies LLC

- Exhibit 64: Cold Chain Technologies LLC – Overview

- Exhibit 65: Cold Chain Technologies LLC – Product and service

- Exhibit 66: Cold Chain Technologies LLC – Key offerings

- 11.7 Continental Cargo OU

- Exhibit 67: Continental Cargo OU – Overview

- Exhibit 68: Continental Cargo OU – Product and service

- Exhibit 69: Continental Cargo OU – Key offerings

- 11.8 Deutsche Post DHL Group

- Exhibit 70: Deutsche Post DHL Group – Overview

- Exhibit 71: Deutsche Post DHL Group – Business segments

- Exhibit 72: Deutsche Post DHL Group – Key news

- Exhibit 73: Deutsche Post DHL Group – Key offerings

- Exhibit 74: Deutsche Post DHL Group – Segment focus

- 11.9 FedEx Corp.

- Exhibit 75: FedEx Corp. – Overview

- Exhibit 76: FedEx Corp. – Business segments

- Exhibit 77: FedEx Corp. – Key news

- Exhibit 78: FedEx Corp. – Key offerings

- Exhibit 79: FedEx Corp. – Segment focus

- 11.10 Kuehne + Nagel International AG

- Exhibit 80: Kuehne + Nagel International AG – Overview

- Exhibit 81: Kuehne + Nagel International AG – Business segments

- Exhibit 82: Kuehne + Nagel International AG – Key news

- Exhibit 83: Kuehne + Nagel International AG – Key offerings

- Exhibit 84: Kuehne + Nagel International AG – Segment focus

- 11.11 Schenker AG

- Exhibit 85: Schenker AG – Overview

- Exhibit 86: Schenker AG – Business segments

- Exhibit 87: Schenker AG – Key news

- Exhibit 88: Schenker AG – Key offerings

- Exhibit 89: Schenker AG – Segment focus

- 11.12 United Parcel Service Inc.

- Exhibit 90: United Parcel Service Inc. – Overview

- Exhibit 91: United Parcel Service Inc. – Business segments

- Exhibit 92: United Parcel Service Inc. – Key news

- Exhibit 93: United Parcel Service Inc. – Key offerings

- Exhibit 94: United Parcel Service Inc. – Segment focus

12 Appendix

- 12.1 Scope of the report

- 12.2 Currency conversion rates for US$

- Exhibit 95: Currency conversion rates for US$

- 12.3 Research methodology

- Exhibit 96: Research Methodology

- Exhibit 97: Validation techniques employed for market sizing

- Exhibit 98: Information sources

- 12.4 List of abbreviations

- Exhibit 99: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/healthcare-logistics-market-size-to-grow-by-usd-33-64-bn-at-a-cagr-of-6-39-pharmaceutical-products-is-expected-to-witness-lucrative-growth–technavio-301555751.html

SOURCE Technavio