Avant Brands Reports Continued Growth in Q2 2024 Financial Results

-

Record Gross Revenue: Generated $9.4 million in gross revenue, establishing a new company record.

-

Strong International Growth: International sales rose 26% to reach a record $3.7 million, now representing 45% of net revenue.

-

Record Cash Flow from Operations1: $4.6 million, highlighting the Company’s ability to produce sustainable and growing cash flows.

-

Record Adjusted Net Income4: Achieved $1.4M, establishing a new historical record and demonstrating significant improvement attributed to effective cost-control measures and increased sales, further bolstering the Company’s profitability.

KELOWNA, BC / ACCESSWIRE / July 15, 2024 / Avant Brands Inc. (TSX:AVNT)(OTCQX:AVTBF)(FRA:1BUP) (“Avant” or the “Company“), a leading producer of innovative and award-winning cannabis products, today released its financial results for the second quarter ended May 31, 2024 (“Q2 2024“). The Company achieved significant financial milestones driven by strategic international expansion and operational improvements.

In Q2 2024, Avant Brands reports records across key financial metrics, underscoring the Company’s commitment to operational excellence. These highlights include:

-

Record Revenues: Gross revenue increased by 5% to a record $9.4 million compared to Q2 2023, while net revenue rose by 4% to a record $8.3 million, demonstrating sustained growth driven by robust international demand.

-

Record International Sales: International sales reached a record $3.7 million, representing a 26% increase over Q2 2023. This success reflects the strong demand for Avant’s premium flower in global markets, with international sales accounting for 45% of net revenue, driven by aggressive market expansion in Australia, Germany, and Israel.

-

Enhanced Profitability: Achieved Adjusted EBITDA2 of $2.8 million, demonstrating continued earnings growth.

-

Continuous Cash Flows: Generated a record $4.6 million in Cash Flow from Operations1, extending a positive cash flow streak through FY2023 and H1 FY2024.

-

Consistent Performance: Adjusted EBITDA2 positive for seven (7) of the past eight (8) quarters, and Cash Flow from Operations1 positive for seven (7) of the past eight (8) quarters.

-

Adjusted Net Income4: Achieved a record of $1.4 million Adjusted Net Income, demonstrating significant improvement attributed to effective cost-control measures and increased sales, further bolstering the Company’s profitability.

Avant Brands Founder & CEO Norton Singhavon Comments:

“Avant Brands is on a strong trajectory, and our Q2 2024 results demonstrate the effectiveness of our strategic initiatives. We are capitalizing on the growing international demand for premium cannabis products, while also achieving record profitability. With a focus on international markets and operational excellence, we are well-positioned for long-term success.”

Fiscal Q2 2024 Financial Highlights (vs. Fiscal Q2 2023):

Record Revenue Growth:

-

Gross Revenue: Record of $9.4 million

-

Net Revenue: Record of $8.3 million (+4%)

-

International Revenue: Record $3.7 million (+26%)

-

Canadian Recreational Revenue: $3.3 million (-30%)

-

Domestic B2B Revenue: $1 million (+396%)

Gross Margin3(before fair value adjustments):

-

Gross Margin3 dollars of $3.0 million (+14%)

-

Gross Margin3 percentage: Increased to 39% (vs. 34%)

Production and Sales:

-

Cannabis Production of 3,186 KG (+59%)

-

Cannabis Sales: 2,708 KG sold (+1%)

Average Selling Prices Across Key Channels:

-

International Selling Price (on-spec product): $4.30 per gram

-

Recreational Cannabis Selling Price (net of excise): $4.98 per gram (vs. $6.73)

-

Weighted Average Selling Price: Decreased to $3.48 per gram (vs. $4.09)

The decrease in the weighted average selling price and overall gross margin was due to liquidating off-spec inventory through domestic wholesale channels. Recreational cannabis prices declined with the Flowr brand relaunch, which has a lower price point than BLK MKT™ and Tenzo™. Notably, Avant’s international sales and recreational brands maintained their pricing integrity, demonstrating resilience against pricing pressures.

Optimizing Cash Flows:

-

Cash Flow from Operations1: Increased to a record of $4.6 million (+126%)

Record Trends in Profitability Metrics:

-

Adjusted EBITDA2 of $2.8 million (+174%)

-

Adjusted EBITDA Margin2 of Net Revenue: Record of 34% (vs. 20%)

-

Adjusted Net Income4: Record of $1.4 million (vs. $0.3 Adjusted Net Loss)

Commercial Highlights:

-

Successful First Shipment to Major New Client: Completed the first shipment to a significant new customer in Israel, further strengthening Avant’s presence in the global cannabis market.

-

Expanding Global Reach: Secured nine new international sales agreements so far in fiscal 2024. These agreements establish a presence in key European markets such as Poland, the UK, and the Czech Republic, positioning Avant for further international growth.

Key Subsequent Events

-

Positioned for Entry into Switzerland: Executed a BLK MKT™ licensing agreement for Switzerland, paving the way for future expansion into this key European market.

-

Growing Distribution Network: Executed a supply agreement with a new client in Portugal, further expanding its international distribution network.

Fiscal 2024 Outlook

Avant’s international strategy has reached a significant milestone, with international sales surpassing domestic adult-use sales for the first time in Q2 2024. This achievement highlights the growing global demand for premium cannabis and Avant’s strategic positioning to capitalize on this opportunity.

Management is confident in the continued expansion of Avant’s international footprint. The company has executed a total of 9 international agreements fiscal year to date, with products already shipped to one client and shipments pending for a further 5 clients. These new clients represent near-term growth potential spanning key territories such as Australia, Germany, and Israel, along with new opportunities developing in the Czech Republic, Poland, Portugal, Switzerland, and the UK. These markets, with a combined population exceeding 250 million, present a substantial growth opportunity for Avant.

This expanded network positions Avant to become a leading player in the global premium cannabis market, with its flagship brand BLK MKT™ well-positioned for international success.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

About Avant Brands Inc.

Avant is an innovative, market-leading premium cannabis company. Avant has multiple operational production facilities across Canada, which produce high-quality, handcrafted cannabis products based on unique and exceptional cultivars.

Avant offers a comprehensive product portfolio catering to recreational, medical, and export markets. Our renowned consumer brands, including BLK MKT™, Tenzo™, Cognōscente™, flowr™ and Treehugger™, are available in key recreational markets across Canada. Avant’s products are distributed globally to Australia, Israel and Germany, with its flagship brand BLK MKT™ currently being sold in Israel. Additionally, Avant’s medical cannabis brand, GreenTec™, serves qualified patients nationwide through its GreenTec Medical portal and trusted medical cannabis partners.

Avant is a publicly traded corporation listed on the Toronto Stock Exchange (TSX: AVNT) and accessible to international investors through the OTCQX Best Market (OTCQX: AVTBF) and Frankfurt Stock Exchange (FRA: 1BU0). Headquartered in Kelowna, British Columbia, Avant operates in strategic locations, including British Columbia, Alberta, and Ontario.

For more information about Avant, including access to investor presentations and details about its consumer brands, please visit www.avantbrands.ca.

For further inquiries, please contact:

Investor Relations at Avant Brands Inc.

1-800-351-6358

ir@avantbrands.ca

Note 1 – Cash Flows from Operations before changes in net-working capital is a non-IFRS performance measure and is calculated by adjusting the net loss from continuing operations for items not affecting cash, before applying changes in non-cash operating working capital.

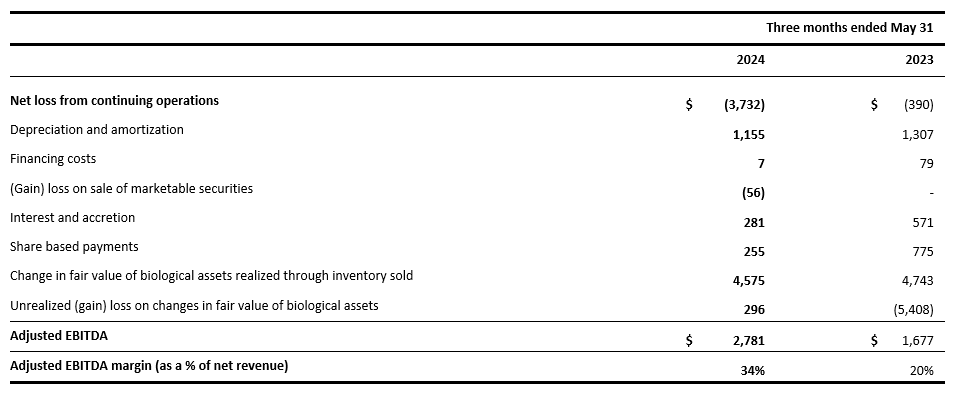

Note 2 – Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS measures. The Company calculates Adjusted EBITDA from continuing operations as net income (loss) before interest expense, income taxes, depreciation and amortization, unrealized gain (loss) on changes in fair value of biological assets, equity loss on investment in associate, loss on sale of assets, investment loss and share based payments. The Company calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management determined that the exclusion of the fair value adjustment is an alternative representation of performance. The fair value adjustment is a non-cash gain (loss) and is based on fair market value less cost to sell. The most directly comparable measure to Adjusted EBITDA (excluding fair value adjustment to biological assets and inventory) calculated in accordance with IFRS is net income (loss) from continuing operations. For more information on the reconciliation of Adjusted EBITDA to net income (loss) and Adjusted EBITDA Margin, please refer to the MD&A or view the reconciliation table at the end of this news release.

Note 3 – Gross margin before fair value adjustments. Please refer to the Financial Statements and MD&A for definitions and a reconciliation to IFRS.

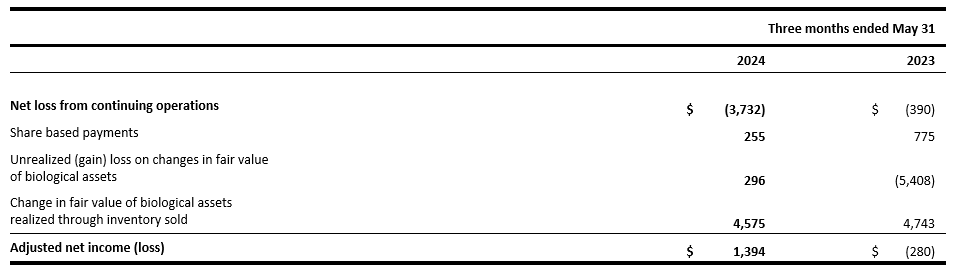

Note 4 – Adjusted Net Income is a non-IFRS performance measure and is calculated by adjusting the net income for items not affecting cash such as; equity loss on investment in associate, share based payments, fair value gain on acquisition, and fair value changes on biological assets. The Company has elected to report Adjusted Net Income, which is a non-IFRS measure, as it believes this metric provides more accurate results of the Company’s financial performance to readers, as it removes the fair value changes on biological assets (amongst other minor adjustments). The most directly comparable measure to Adjusted Net Income calculated in accordance with IFRS is net income (loss) from continuing operations. For more information on the reconciliation of Adjusted Net Income, please refer to the MD&A at page 10 or view the reconciliation table at the end of this news release.

RECONCILIATION OF ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

ADJUSTED EBITDA (NON-IFRS PERFORMANCE MEASUREMENT)

The Company has identified Adjusted EBITDA and Adjusted EBITDA Margin as relevant industry performance indicators. Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS financial measures used by management that do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

Management defines Adjusted EBITDA as income (loss) from continuing operations, as reported, adjusted for depreciation and amortization, equity (gain) loss on investment in associate, financing costs, gains and losses on sale of marketable securities, Canadian emergency wage subsidy, interest and accretion, share-based payments, fair value gain on acquisition, impairment of inventory, change in fair value of biological assets realized through inventory sold, and unrealized gains and losses on changes in fair value of biological assets. Management calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management believes these measures provide useful information as commonly used measures in the capital markets to approximate operating earnings. See table below for determination of specific components of Adjusted EBITDA and Adjusted EBITDA Margin.

RECONCILIATION OF ADJUSTED NET INCOME (LOSS)

ADJUSTED NET INCOME (LOSS) NON-IFRS PERFORMANCE MEASUREMENT

The Company has identified adjusted net income as a relevant industry performance indicator. Adjusted net income is a non-IFRS financial measure used by management that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

Management defines adjusted net income as income (loss) from continuing operations, as reported, adjusted for equity (gain) loss on investment in associate, share-based payments, fair value gain on acquisition, change in fair value of biological assets realized through inventory sold, and unrealized gains and losses on changes in fair value of biological assets. Management believes this measure provides useful information as it is a commonly used measure in the capital markets to approximate operating earnings. See the table below for the determination of specific components of adjusted net income.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

This news release includes certain “forward-looking information” as defined under applicable Canadian securities legislation, encompassing statements regarding Avant Brands Inc.’s (“Avant” or the “Company”) plans, intentions, beliefs, and current expectations concerning future business activities and operating performance. Forward-looking information is often identified by words such as “may,” “would,” “could,” “should,” “will,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “expect,” or similar expressions. It covers various aspects, including the Company’s expectations for future revenue growth, demonstrated by its record Q2 net revenue. Additionally, it includes plans for international market expansion, such as the surge in international sales and securing agreements with new international partners, reflecting Avant’s strategic initiatives. Furthermore, the forward-looking information addresses the Company’s efforts in brand building, particularly in establishing and strengthening its premium cannabis brands like BLK MKT™. It also encompasses strategies for product development to meet evolving consumer preferences and market trends, as well as the focus on maintaining cost controls and operational efficiencies to enhance profitability and financial performance, and the company’s expected continued growth. Moreover, the forward-looking information considers the anticipated performance of the BLK MKTᵀᴹ brand in the global cannabis industry, supported by successful international expansion and strategic partnerships. Lastly, it mentions the expected availability of the Audited Financial Statements and the MD&A on the Company’s SEDAR+ profile and website, providing investors with comprehensive financial information. Investors should be aware that forward-looking information involves inherent risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such information. Management’s current expectations may not accurately predict future events or outcomes. Therefore, investors are cautioned not to place undue reliance on forward-looking information.

Investors are cautioned that forward-looking information is not based on historical fact but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the Company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: regulatory and licensing risks; changes in consumer demand and preferences; changes in general economic, business and political conditions, including changes in the financial markets; the global regulatory landscape and enforcement related to cannabis, including political risks and risks relating to regulatory change; compliance with extensive government regulation; public opinion and perception of the cannabis industry; the impact of COVID-19; and the risk factors set out in the Company’s annual information form dated February 28, 2024, filed with Canadian securities regulators and available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors that could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information, which speak only as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

This news release refers to certain financial performance measures that are not defined by and do not have a standardized meaning under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. These non-IFRS financial performance measures are defined in the MD&A. Non-IFRS financial measures are used by management to assess the financial and operational performance of the Company. The Company believes that these non-IFRS financial measures, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company’s operating results, underlying performance and prospects in a similar manner to the Company’s management. As there are no standardized methods of calculating these non-IFRS measures, the Company’s approaches may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, these non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

SOURCE: Avant Brands Inc.

View the original press release on accesswire.com

View the original press release on accesswire.com