Life Sciences Software Market Value to grow by USD 2.55 Billion | High demand expected in North America | Technavio

NEW YORK, May 10, 2022 /PRNewswire/ — The life sciences software market research report by Technavio provides valuable insights to help enterprises advance in their business approaches. The report helps businesses deduce end goals and redefine their marketing strategies to gain a competitive advantage.

A sample copy of this report is available upon request. The sample report consists of the following information:

- Introduction and a brief overview of the in-depth analysis included in the full report.

- Market sizing approaches used for developing a comprehensive view of the market

- Post pandemic recovery analysis

- Analysis of the competitive structure and the market behavior of participants

- Key market players, their business strategies, sales volume, and revenue analysis

- Regional market analysis with a graphical representation of size, share, and trends for the year 2020

- Factors that define market characteristics

See for yourself and understand how the purchase of the report can have a direct impact on your revenue.

View Our Sample Report Here

Frequently asked questions about this report:

What is the forecasted growth in the life sciences software market?

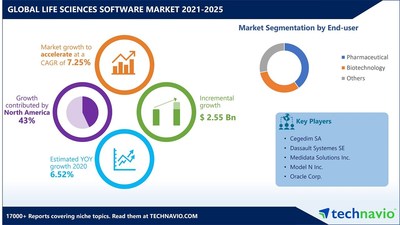

The global market size is expected to grow by USD 2.55 billion between 2020 and 2025, expanding at a CAGR of 7.25%.

What is the YOY growth rate of the life sciences software market in 2021?

The global life sciences software market observed a YOY growth rate of 6.52% in 2020.

Which end-user segment accounted for the largest market share in 2021?

Based on the end-users, the pharmaceutical segment accounted for the largest share in the market in 2021.

Who are the key players in the market?

Cegedim SA, Dassault Systemes SE, Medidata Solutions Inc., Model N Inc., Oracle Corp., PTC Therapeutics Inc., SAP SE, SAS Institute Inc., Thermo Fisher Scientific Inc., and Veeva Systems Inc. are identified as the key players in the market.

What factors are driving the life sciences software market growth?

The growing focus on storing patient information is one of the key factors driving the growth of the market.

Got more questions? Our analyst can help you find what you are looking for. Speak to Our Analyst Now

Competitive Analysis

The global life sciences software market is fragmented. The market is characterized by the presence of many regional and well-established players. Vendors operating in the market are deploying growth strategies such as new product launches and mergers and acquisitions to compete in the market. For instance, in May 2021, Dassault Systemes SE partnered with Skidmore Group to deliver the first implementation of HomeByMe for Kitchen Retailers in North America. Similarly, in April 2021, SAP SE and investment company Dediq GmbH announced that they had agreed to enter into a partnership in the area of financial services. The two companies would jointly expand the SAP financial services portfolio with a significant investment in new solutions.

Some of the recent developments in the vendor landscape in terms of product launches include:

Cegedim SA: The company offers medical software, pharmacist software, paramedical software, drug database as well as technological tools, specialized software, data flow management services, and databases.

Dassault Systemes SE: The company offers software for business processes, strategic planning, regulatory frameworks, and technological solutions.

Medidata Solutions Inc.: The company offers cloud-based platform of solutions, data analytics, and AI that enables efficiency and improves quality throughout clinical development programs by accelerating processes, enhancing decision-making, minimizing operational risk, reducing costs, and transforming trial strategies.

Download a Report Sample to identify other vendors profiled in the full report.

This report can be customized as per your specific requirements. Our analysts can break down market segmentation for requested regions and segments. The report can also be customized to provide you with detailed profiling of additional market players, vendor segmentation, and products offered by vendors.

This report can be customized to suit your business needs. Our analysts are available 24/5 round the clock to assist you with any queries. Speak To Our Analyst Now

Customers who bought this report also purchased:

Healthcare Information Systems Market by Application and Geography – Forecast and Analysis 2022-2026

|

Life Science Software Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.25% |

|

Market growth 2021-2025 |

USD 2.55 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

6.52 |

|

Regional analysis |

North America, Europe, APAC, South America, North America, Europe, APAC, and South America |

|

Performing market contribution |

North America at 43% |

|

Key consumer countries |

US, Germany, France, and Japan |

|

Competitive landscape |

Leading companies, competitive strategies, consumer engagement scope |

|

Companies profiled |

Cegedim SA, Dassault Systemes SE, Medidata Solutions Inc., Model N Inc., Oracle Corp., PTC Therapeutics Inc., SAP SE, SAS Institute Inc., Thermo Fisher Scientific Inc., and Veeva Systems Inc. |

|

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for the forecast period, |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of Contents:

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: Application software

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.3 Market size 2020

- 3.4 Market outlook: Forecast for 2020 – 2025

- Exhibit 06: Global – Market size and forecast 2020 – 2025 ($ million)

- Exhibit 07: Global market: Year-over-year growth 2020 – 2025 (%)

4 Five Forces Analysis

- 4.1 Five forces summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition – Five forces 2020

5 Market Segmentation by End-user

- 5.1 Market segments

- Exhibit 15: End-user – Market share 2020-2025 (%)

- 5.2 Comparison by End-user

- Exhibit 16: Comparison by End-user

- 5.3 Pharmaceutical – Market size and forecast 2020-2025

- Exhibit 17: Pharmaceutical – Market size and forecast 2020-2025 ($ million)

- Exhibit 18: Pharmaceutical – Year-over-year growth 2020-2025 (%)

- 5.4 Biotechnology – Market size and forecast 2020-2025

- Exhibit 19: Biotechnology – Market size and forecast 2020-2025 ($ million)

- Exhibit 20: Biotechnology – Year-over-year growth 2020-2025 (%)

- 5.5 Others – Market size and forecast 2020-2025

- Exhibit 21: Others – Market size and forecast 2020-2025 ($ million)

- Exhibit 22: Others – Year-over-year growth 2020-2025 (%)

- 5.6 Market opportunity by End-user

- Exhibit 23: Market opportunity by End-user

6 Market Segmentation by Deployment

- 6.1 Market segments

- Exhibit 24: Deployment – Market share 2020-2025 (%)

- 6.2 Comparison by Deployment

- Exhibit 25: Comparison by Deployment

- 6.3 Cloud – Market size and forecast 2020-2025

- Exhibit 26: Cloud – Market size and forecast 2020-2025 ($ million)

- Exhibit 27: Cloud – Year-over-year growth 2020-2025 (%)

- 6.4 On-premise – Market size and forecast 2020-2025

- Exhibit 28: On-premise – Market size and forecast 2020-2025 ($ million)

- Exhibit 29: On-premise – Year-over-year growth 2020-2025 (%)

- 6.5 Market opportunity by Deployment

- Exhibit 30: Market opportunity by Deployment

7 Customer landscape

8 Geographic Landscape

- 8.1 Geographic segmentation

- Exhibit 32: Market share by geography 2020-2025 (%)

- 8.2 Geographic comparison

- Exhibit 33: Geographic comparison

- 8.3 North America – Market size and forecast 2020-2025

- Exhibit 34: North America – Market size and forecast 2020-2025 ($ million)

- Exhibit 35: North America – Year-over-year growth 2020-2025 (%)

- 8.4 Europe – Market size and forecast 2020-2025

- Exhibit 36: Europe – Market size and forecast 2020-2025 ($ million)

- Exhibit 37: Europe – Year-over-year growth 2020-2025 (%)

- 8.5 APAC – Market size and forecast 2020-2025

- Exhibit 38: APAC – Market size and forecast 2020-2025 ($ million)

- Exhibit 39: APAC – Year-over-year growth 2020-2025 (%)

- 8.6 South America – Market size and forecast 2020-2025

- Exhibit 40: South America – Market size and forecast 2020-2025 ($ million)

- Exhibit 41: South America – Year-over-year growth 2020-2025 (%)

- 8.7 MEA – Market size and forecast 2020-2025

- Exhibit 42: MEA – Market size and forecast 2020-2025 ($ million)

- Exhibit 43: MEA – Year-over-year growth 2020-2025 (%)

- 8.8 Key leading countries

- Exhibit 44: Key leading countries

- 8.9 Market opportunity by geography

- Exhibit 45: Market opportunity by geography

9 Drivers, Challenges, and Trends

- 9.1 Market drivers

- 9.2 Market challenges

- Exhibit 46: Impact of drivers and challenges

- 9.3 Market trends

10 Vendor Landscape

- 10.1 Competitive scenario

- 10.2 Vendor landscape

- Exhibit 47: Vendor landscape

- 10.3 Landscape disruption

11 Vendor Analysis

- 11.1 Vendors covered

- Exhibit 50: Vendors covered

- 11.2 Market positioning of vendors

- Exhibit 51: Market positioning of vendors

- 11.3 Cegedim SA

- Exhibit 52: Cegedim SA – Overview

- Exhibit 53: Cegedim SA – Business segments

- Exhibit 54: Cegedim SA – Key offerings

- Exhibit 55: Cegedim SA – Segment focus

- 11.4 Dassault Systemes SE

- Exhibit 56: Dassault Systemes SE – Overview

- Exhibit 57: Dassault Systemes SE – Product and service

- Exhibit 58: Dassault Systemes SE – Key news

- Exhibit 59: Dassault Systemes SE – Key offerings

- 11.5 International Business Machines Corp.

- Exhibit 60: International Business Machines Corp. – Overview

- Exhibit 61: International Business Machines Corp. – Business segments

- Exhibit 62: International Business Machines Corp. – Key news

- Exhibit 63: International Business Machines Corp. – Key offerings

- Exhibit 64: International Business Machines Corp. – Segment focus

- 11.6 Model N Inc.

- Exhibit 65: Model N Inc. – Overview

- Exhibit 66: Model N Inc. – Business segments

- Exhibit 67: Model N Inc. – Key offerings

- Exhibit 68: Model N Inc. – Segment focus

- 11.7 Oracle Corp.

- Exhibit 69: Oracle Corp. – Overview

- Exhibit 70: Oracle Corp. – Business segments

- Exhibit 71: Oracle Corp. – Key offerings

- Exhibit 72: Oracle Corp. – Segment focus

- 11.8 PTC Therapeutics Inc.

- Exhibit 73: PTC Therapeutics Inc. – Overview

- Exhibit 74: PTC Therapeutics Inc. – Business segments

- Exhibit 75: PTC Therapeutics Inc. – Key offerings

- Exhibit 76: PTC Therapeutics Inc. – Segment focus

- 11.9 SAP SE

- Exhibit 77: SAP SE – Overview

- Exhibit 78: SAP SE – Business segments

- Exhibit 79: SAP SE – Key news

- Exhibit 80: SAP SE – Key offerings

- Exhibit 81: SAP SE – Segment focus

- 11.10 SAS Institute Inc.

- Exhibit 82: SAS Institute Inc. – Overview

- Exhibit 83: SAS Institute Inc. – Product and service

- Exhibit 84: SAS Institute Inc. – Key offerings

- 11.11 Thermo Fisher Scientific Inc.

- Exhibit 85: Thermo Fisher Scientific Inc. – Overview

- Exhibit 86: Thermo Fisher Scientific Inc. – Business segments

- Exhibit 87: Thermo Fisher Scientific Inc. – Key news

- Exhibit 88: Thermo Fisher Scientific Inc. – Key offerings

- Exhibit 89: Thermo Fisher Scientific Inc. – Segment focus

- 11.12 Veeva Systems Inc.

- Exhibit 90: Veeva Systems Inc. – Overview

- Exhibit 91: Veeva Systems Inc. – Business segments

- Exhibit 92: Veeva Systems Inc. – Key offerings

- Exhibit 93: Veeva Systems Inc. – Segment focus

12 Appendix

- 12.1 Scope of the report

- 12.2 Currency conversion rates for US$

- Exhibit 94: Currency conversion rates for US$

- 12.3 Research methodology

- Exhibit 95: Research Methodology

- Exhibit 96: Validation techniques employed for market sizing

- Exhibit 97: Information sources

- 12.4 List of abbreviations

- Exhibit 98: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/life-sciences-software-market-value-to-grow-by-usd-2-55-billion–high-demand-expected-in-north-america–technavio-301542618.html

SOURCE Technavio