Spectral Medical Announces Third Quarter Results and Provides Corporate Update

Tigris Trial Enrollment Reaches 76 Patients

Crude mortality results continue to exceed expectations

TORONTO, Nov. 09, 2023 (GLOBE NEWSWIRE) — Spectral Medical Inc. (“Spectral” or the “Company”) (TSX: EDT), a late-stage theranostic company advancing therapeutic options for sepsis and septic shock, today announced its financial results for the third quarter ended September 30, 2023 and provided a corporate update.

During the third quarter, the Company continued to experience momentum in Tigris Trial enrollment. Management is pleased to report positive progress on these initiatives to increase Tigris Trial enrollment, specifically:

- During and subsequent to the third quarter the Company enrolled an additional eleven patients, of which nine or approximately 80% came from new sites opened for enrollment in 2023;

- 76 patients enrolled to date and the Company continues to close in on its interim target of 90 patients, an important milestone as Spectral’s strategic commercial partner, Baxter (BAX:NYSE), will have the opportunity to view the data as well as provide a second milestone payment to Spectral;

- Addition of two new trial sites, the Mayo Clinic and Emory Healthcare, subsequent to the third quarter bringing current total trial sites to 20;

- During the third quarter, full transition from the incumbent CRO, Beaufort was completed;

- Spectral Medical was featured in an episode of the ‘The Balancing Act’ airing on Lifetime TV (Advancing Therapeutic Options for Sepsis and Endotoxic Septic Shock – The Balancing Act) focused on advancing therapeutic options for sepsis and endotoxic septic shock, which was aired during the quarter; and

- On September 7, 2023, Spectral completed a private placement of convertible notes for gross proceeds of USD$4,553,000 led by the Company’s strategic investors Baxter and Pinnacle Island LP.

Dr. John Kellum, Chief Medical Officer of Spectral Medical, stated, “We continue to experience patient enrollment momentum supported by new sites we have onboarded during 2023. We continue to make progress opening additional sites, which should positively impact the pace of enrollment. Overall, we are rapidly advancing our Tigris trial and remain highly encouraged by the outlook, given the fact preliminary mortality data continues to exceed our expectations.”

“We are taking measured, yet rapid action to maintain and even increase momentum in patient enrollment with a view to enrolling our interim count of 90 patients, which is expected to play as a major catalyst for the Company,” said Chris Seto, Chief Executive Officer of Spectral Medical. “Based on the pace of patient enrollment in the past number of months, and our activities around site additions, we continue to drive towards the 90 patient interim milestone.”

Financial Review

Revenue for three months ended September 30, 2023, was $397,000 compared to $362,000 for the same period last year, representing an increase of $35,000, or 9.7%. Revenue for six months ended September 30, 2023, was $1,233,000 and $1,114,000 for the same period last year, representing an increase of $119,000, or 10.7%. This increase was mainly due to an increase in proprietary biochemicals product revenue.

Operating expenses for the three months ended September 30, 2023, were $3,658,000, compared to $2,705,000 for the same period in the prior year, an increase of $953, or 35.2%. The change is primarily due to an increase in consulting and professional fees by $265,000 primarily due to increased site and patient fees related to the Tigris trial and Eden observational study. Interest expense increased $167,000 primarily related to the Notes Payable, which was not outstanding in the same period in the prior year. Foreign exchange loss increased by $127,000 over the same period in the prior year, primarily related to FX loss on USD cash balances. Operating expenses for the nine months ended September 30, 2023, were $10,215,000, compared to $7,552,000 for the same period in the preceding year, an increase of $2,663, or 35.2%. The change is due to an increase in share-based compensation of $295,000. In addition, consulting and professional fees increased by $1,240,000 primarily due to increased site and patient fees related to the Tigris trial and Eden observational study. Interest expense increased $410,000 primarily related to the Notes Payable, which was not outstanding in the same period in the prior year. Lastly, loss incurred on joint arrangement was $205,000 which was not incurred for the same period in the prior year.

Loss for the three months ended September 30, 2023 was $3,391,000, or $0.01 per share, compared to a loss of $3,135,000, or $0.01 per share, for the same quarter last year. The increased loss of $256,000 was due to increased operating expenses, partially offset by a reduction in loss from discontinued operations of $662,000 related to the reduction in Dialco operating expenses. Loss for the nine months ended September 30, 2023 was $9,107,000, or $0.02 per share, compared to a loss of $8,778,000, or $0.01 per share, for the same period last year. The increased loss of $329,000 was due to increased operating expenses, partially offset by a reduction in loss from discontinued operations of $2,215,000 related to the prior Dialco operating expenses.

The Company concluded the third quarter of 2023 with cash of $5,031,000 compared to $8,414,000 of cash on hand as of December 31, 2022.

The total number of common shares outstanding for the Company was 278,576,261 at September 30, 2023.

About Spectral

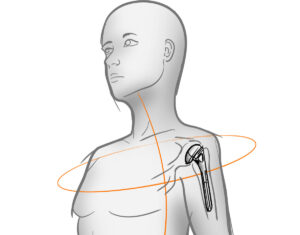

Spectral is a Phase 3 company seeking U.S. FDA approval for its unique product for the treatment of patients with septic shock, Toraymyxin™ (“PMX”). PMX is a therapeutic hemoperfusion device that removes endotoxin, which can cause sepsis, from the bloodstream and is guided by the Company’s Endotoxin Activity Assay (EAA™), the only FDA cleared diagnostic for the risk of developing sepsis.

PMX is approved for therapeutic use in Japan and Europe, and has been used safely and effectively on more than 340,000 patients to date. In March 2009, Spectral obtained the exclusive development and commercial rights in the U.S. for PMX, and in November 2010, signed an exclusive distribution agreement for this product in Canada. In July 2022, the U.S. FDA granted Breakthrough Device Designation for PMX for the treatment of endotoxic septic shock. Approximately 330,000 patients are diagnosed with septic shock in North America each year.

Spectral is listed on the Toronto Stock Exchange under the symbol EDT. For more information please visit www.spectraldx.com.

Forward-looking statement

Information in this news release that is not current or historical factual information may constitute forward-looking information within the meaning of securities laws. Implicit in this information, particularly in respect of the future outlook of Spectral and anticipated events or results, are assumptions based on beliefs of Spectral’s senior management as well as information currently available to it. While these assumptions were considered reasonable by Spectral at the time of preparation, they may prove to be incorrect. Readers are cautioned that actual results are subject to a number of risks and uncertainties, including the company’s ability to raise capital and the availability of funds and resources to pursue R&D projects, the recruitment of additional clinical trial sites, the rate of patient enrollment, the successful and timely completion of clinical studies, the success of Baxter’s commercialization efforts, the ability of Spectral to take advantage of business opportunities in the biomedical industry, the granting of necessary approvals by regulatory authorities as well as general economic, market and business conditions, and could differ materially from what is currently expected.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this statement.

For further information, please contact:

| Ali Mahdavi | David Waldman/Natalya Rudman | Blair McInnis |

| Capital Markets & Investor Relations | US Investor Relations | CFO |

| Spinnaker Capital Markets Inc. | Crescendo Communications, LLC | Spectral Medical Inc. |

| 416-962-3300 | 212-671-1020 | 416-626-3233 |

| am@spinnakercmi.com | edt@crescendo-ir.com | bmcinnis@spectraldx.com |

Spectral Medical Inc.

Condensed Interim Consolidated Statements of Financial Position

In CAD (000s), except for share and per share data

(Unaudited)

| September 30, 2023 |

December 31, 2022 |

|||

| $ | $ | |||

| Assets | ||||

| Current assets | ||||

| Cash | 5,031 | 8,414 | ||

| Trade and other receivables | 720 | 1,056 | ||

| Inventories | 304 | 340 | ||

| Prepayments and other assets | 912 | 276 | ||

| 6,967 | 10,086 | |||

| Non-current assets | ||||

| Right-of-use-asset | 598 | 464 | ||

| Property and equipment | 165 | 237 | ||

| Intangible asset | 192 | 211 | ||

| Investment in iDialco | 794 | 998 | ||

| Total assets | 8,716 | 11,996 | ||

| Liabilities | ||||

| Current liabilities | ||||

| Trade and other payables | 2,314 | 3,167 | ||

| Current portion of contract liabilities | 757 | 696 | ||

| Current portion of lease liability | 121 | 96 | ||

| 3,192 | 3,959 | |||

| Non-current liability | ||||

| Lease liability | 535 | 420 | ||

| Non-current portion of contract liabilities | 3,509 | 4,011 | ||

| Notes payable | 11,631 | 6,129 | ||

| Total liabilities | 18,867 | 14,519 | ||

| Shareholders’ deficiency | ||||

| Share capital | 87,061 | 87,050 | ||

| Contributed surplus | 8,916 | 8,773 | ||

| Share-based compensation | 10,197 | 8,908 | ||

| Warrants | 2,526 | 2,490 | ||

| Deficit | (118,851 | ) | (109,744 | ) |

| Total shareholders’ deficiency | (10,151 | ) | (2,523 | ) |

| Total liabilities and shareholders’ deficiency | 8,716 | 11,996 | ||

Spectral Medical Inc.

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

In CAD (000s), except for share and per share data

(Unaudited)

| Three- months ended September 30, 2023 |

Three- months ended September 30, 2022 |

Nine- months ended September 30, 2023 |

Nine- months ended September 30, 2022 |

||||||

| $ | $ | $ | $ |

||||||

| Revenue | 397 | 362 | 1,233 | 1,114 | |||||

| Expenses | |||||||||

| Changes in inventories of finished goods and work-in-process |

– | 71 | – | 160 | |||||

| Raw materials and consumables used | 305 | 121 | 722 | 357 | |||||

| Salaries and benefits | 987 | 891 | 2,918 | 2,555 | |||||

| Consulting and professional fees | 1,198 | 933 | 3,300 | 2,060 | |||||

| Regulatory and investor relations | 109 | 123 | 414 | 442 | |||||

| Travel and entertainment | 63 | 78 | 245 | 197 | |||||

| Facilities and communication | 81 | 81 | 245 | 218 | |||||

| Insurance | 102 | 119 | 290 | 357 | |||||

| Depreciation and amortization | 57 | 55 | 172 | 171 | |||||

| Interest expense | 173 | 6 | 429 | 19 | |||||

| Foreign exchange (gain) loss | 146 | 19 | (89 | ) | 30 | ||||

| Share-based compensation | 340 | 217 | 1,300 | 1,005 | |||||

| Other expense (income) | 56 | (9 | ) | 64 | 19 | ||||

| Net Loss on joint arrangement | 41 | – | 205 | – | |||||

| 3,658 | 2,705 | 10,215 | 7,552 | ||||||

| Loss and comprehensive loss for the year from continuing operations |

(3,261 | ) | (2,343 | ) | (8,982 | ) |

(6,438 |

) |

|

| Income (loss) from discontinued operations |

(130 | ) | (792 | ) |

(125 |

) |

(2,340 |

) |

|

| Loss and comprehensive loss for the year | (3,391 | ) | (3,135 | ) | (9,107 | ) | (8,778 | ) | |

| Basic and diluted loss from continuing operations per common share |

(0.01 | ) | (0.00 | ) |

(0.02 |

) |

(0.01 | ) | |

| Basic and diluted income (loss) from discontinued operations per common share |

(0.00 | ) | (0.00 | ) |

(0.00 |

) |

(0.00 | ) | |

| Basic and diluted loss per common share |

(0.01 | ) | (0.01 | ) | (0.02 | ) | (0.02 | ) | |

| Weighted average number of common shares outstanding – basic and diluted |

278,604,718 | 268,283,387 |

278,569,902 |

268,064,079 |

|||||

Spectral Medical Inc.

Condensed Interim Consolidated Statements of Changes in Shareholders’ Deficiency

In CAD (000s)

(Unaudited)

| Number of shares |

Share Capital |

Contributed surplus |

Share-based |

Warrants | Deficit | Total Shareholders’ (deficiency) |

|||||||||

| $ | $ | $ | $ | $ | $ |

||||||||||

| Balance, January 1, 2022 | 267,886,408 | 84,357 | 7,985 | 7,984 | 2,251 | (98,494 | ) | 4,083 | |||||||

| Share options exercised | 268,797 | 157 | – | (69 | ) | – | – | 88 | |||||||

| RSUs released | 284,072 | 174 | – | (174 | ) | – | – | – | |||||||

| Warrants expired | – | – | 788 | – | (788 | ) | – | – | |||||||

| Loss and comprehensive loss for the period | – | – | – | – | – | (8,778 | ) | (8,778 | ) | ||||||

| Share-based compensation | – | – | – | 1,005 | – | – | 1,005 | ||||||||

| Balance, Sep 30, 2022 | 268,439,277 | 84,688 | 8,773 | 8,746 | 1,463 | (107,272 | ) | (3,602 | |||||||

| Bought deal offering | 10,061,250 | 2,313 | – | – | 1,027 | – | 3,340 | ||||||||

| RSU Released | 47,277 | 49 | – | (30 | ) | – | – | 19 | |||||||

| Loss and comprehensive loss for the period | – | – | – | – | – | (2,472 | ) | (2,472 | |||||||

| Share-based compensation | – | – | – | 192 | – | – | 192 | ||||||||

| Balance, December 31, 2022 | 278,547,804 | 87,050 | 8,773 | 8,908 | 2,490 | (109,744 | ) | (2,523 | |||||||

| Balance, January 1, 2023 | 278,547,804 | 87,050 | 8,773 | 8,908 | 2,490 | (109,744 | ) | (2,523 | ) | ||

| RSUs released | 28,457 | 11 | – | (11 | ) | – | – | – | |||

| Warrants issued | – | – | – | – | 179 | – | 179 | ||||

| Warrants expired | – | – | 143 | – | (143 | ) | – | – | |||

| Loss and comprehensive loss for the period |

– | – | – | – | – | (9,107 | ) | (9,107 | ) | ||

| Share-based compensation | – | – | – | 1,300 | – | – | 1,300 | ||||

| Balance, September 30, 2023 | 278,576,261 | 87,061 | 8,916 | 10,197 | 2,526 | (118,851 | ) | (10,151 | ) |

Spectral Medical Inc.

Condensed Interim Consolidated Statements of Cash Flows

In CAD (000s)

(Unaudited)

| Nine-months ended Sep 30, 2023 |

Nine-months ended Sep 30, 2022 |

|||

| $ | $ | |||

| Cash flow provided by (used in) | ||||

| Operating activities | ||||

| Loss and comprehensive loss for the period | (9,107 | ) | (8,778 | ) |

| Adjustments for: | ||||

| Depreciation on right-of-use asset | 73 | 71 | ||

| Depreciation on property and equipment | 72 | 123 | ||

| Amortization of intangible asset | 19 | 13 | ||

| Amortization of deferred financing Fees | 147 | – | ||

| Interest expense | 429 | 19 | ||

| Unrealized foreign exchange gain | (38 | ) | (33 | ) |

| Share-based compensation | 1,479 | 1,005 | ||

| Write down of property and equipment to fair value | 91 | |||

| Loss on investment in iDialco | 205 | – | ||

| Changes in items of working capital: | ||||

| Trade and other receivables | 336 | 129 | ||

| Inventories | 36 | (367 | ) | |

| Prepayments and other assets | (636 | ) | 77 | |

| Trade and other payables | (1,253 | ) | 493 | |

| Contract liabilities | (648 | ) | (485 | ) |

| Net cash used in operating activities | (8,886 | ) | (7,642 | ) |

| Investing activities | ||||

| Property and equipment acquisitions | – | (90 | ) | |

| Net cash used in investing activities | – | (90 | ) | |

| Financing activities | ||||

| Lease liability payments | 110 | (88 | ) | |

| Note payable | 6,213 | |||

| Financing charges paid | (820 | ) | ||

| Share options exercised | – | 88 | ||

| Net cash provided by financing activities | 5,503 | – | ||

| Decrease in cash | (3,383 | ) | (7,732 | ) |

| Effects of exchange rate changes on cash | – | 33 | ||

| Cash, beginning of period | 8,414 | 8,890 | ||

| Cash, end of period | 5,031 | 1,191 | ||